Can I Put Leftover Grant Money In Savings

4 Min Read | Aug 26, 2021

Every now and and so something magical happens. No, we're not talking about finding a $1,000 bill on the ground. Although, that would be all kinds of magical.

Nosotros're talking about the pleasant surprise of finding leftover money in your budget! Maybe gas prices went downwardly or the weather was incredible and y'all didn't take to run your air conditioner as much. Or maybe yous simply landed a wink sale on your vacation must-reads.

Any the awesome reason, now y'all have more cash to spend, save or requite in your budget. Afterwards you cease your happy trip the light fantastic, brand sure you put that coin to good use right away. Wondering where should it go?

Give Every Dollar a Proper name

-

Speed Upward Your Progress. If you are on Infant Step 1, 2 or 3, nosotros recommend putting that leftover money toward your current Baby Step. For example, with an extra $100 a month, you tin pay off a $10,000 student loan a piffling over five years earlier! Plus, you'll end up saving $i,500 in involvement while y'all're at it. See ya, debt.

-

Give It a Skilful Dwelling house. If yous've finished Baby Step 3 and have your full emergency fund in identify, you may desire to put the money toward a fun expense similar your upcoming beach trip. Or that new jacket you lot've been eyeing at Nordstrom Rack. Or your car insurance bill (non as fun, we acknowledge, but you'll probably score the lump-sum payment discount!). You lot could even surprise a friend who's having a hard time with a gift card to his or her favorite place. Information technology's your call!

-

Treat yourself. Another option is to roll the leftover money into next month's budget. Let's say y'all're $75 under in your eatery budget because yous caught the grilling problems this month (yum). Put the extra money in next month's budget to treat yourself to a table at ane of those fancy, trendy spots you never visit anymore!

Whether you spend, save or give your leftover cash, information technology'due south a win for your upkeep. Try information technology and run into what we mean! At present for the fun part—finding the money in the start identify. Here's how to practise it with EveryDollar:

Commencement budgeting with EveryDollar today!

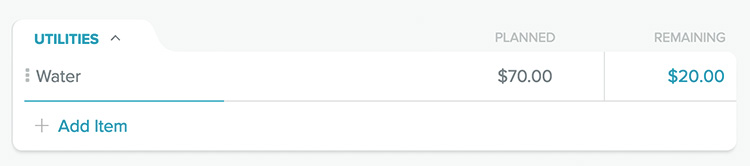

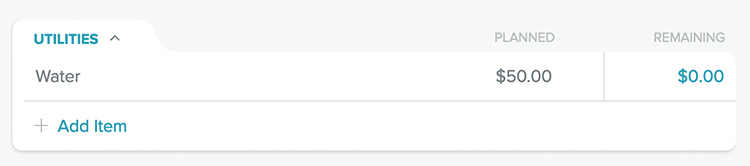

1. Suit As You Go. Let's say information technology's the heart of the month and y'all planned $70 for h2o/sewer, but your bill was only $50 (nice!). Don't look until the cease of the month to budget that coin. Go ahead and pull upward your EveryDollar budget, and suit your "planned" column to reflect the new amount. Then put that extra $20 elsewhere. The do good of changing your budget as you go is that your money never sits around waiting to piece of work for you. It's agile all month long!

Original planned corporeality:

Updated planned amount:

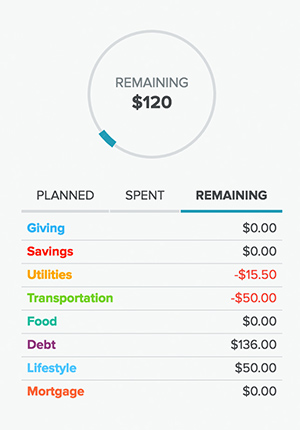

2. Give It Another Overall Glance. At the end of the calendar month, it's a skillful idea to double-check your upkeep for leftover cash. To detect it, wait at the helpful charts in your EveryDollar budget where you see your income. Y'all'll detect three categories: "planned," "spent" and "remaining." Click the "remaining" tab to run into your leftover cash. If it says $30 (oops, you forgot to become that haircut!), go alee and assign your extra coin to side by side calendar month'south budget.

When you give every dollar a name, you're in control of your money at all times. If you're able to spend less than you planned on a given category, that's a neat opportunity to salvage, eliminate debt, or be a generous giver. Become you!

Don't have an EveryDollar budget yet? No problem. It's gratuitous to create your budget and takes less than 10 minutes. The savings you lot discover will make it more than than worth your time!

About the author

Ramsey Solutions

Go a FREE Customized Plan for Your Coin!

Answer a few questions, and we'll create a plan tailored just for yous. It only takes iii minutes!

Take the Assessment

Get a Complimentary Customized Program for Your Money!

Respond a few questions, and we'll create a plan tailored merely for you. It merely takes three minutes!

Take the Free Cess

Start Budgeting for Complimentary

Start Budgeting for Costless

Source: https://www.ramseysolutions.com/budgeting/the-budget-tips-you-need-to-find-extra-cash

Posted by: arnoldforling.blogspot.com

0 Response to "Can I Put Leftover Grant Money In Savings"

Post a Comment